Only fans taxes - Tax Memo

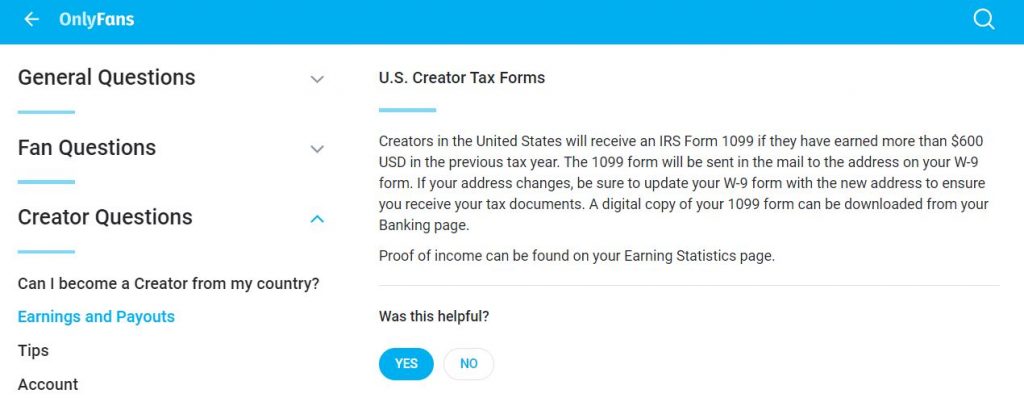

The Ultimate Guide To Filing Your OnlyFans 1099 Taxes

Click here to check it out on Amazon.

Many governments help citizens do their taxes electronically, often for free.

There are two major types of freelance content creators.

Memo

The two parties involved can rest assured that they're legal rights are protected, and the terms of the contract are sufficiently documented.

If so, then you don't need to file.

Description: On the one hand, social media platforms, such as onlyfans, are forcing the cra to find new innovative methods to conduct its income tax audit and verification techniques.

Sexy:

Funny:

Views: 5309

Date: 26.03.2022

Favorited: 22

Category: DEFAULT

User Comments 3

The more you can document the elements of a contract, the better your chances of legally enforcing a oral contract.

More Photos

Latest Photos

Latest Comments

- +905reps

- Taxpayers can also claim write offs or deductions on some taxes that they have paid.

- By: Kress

- +640reps

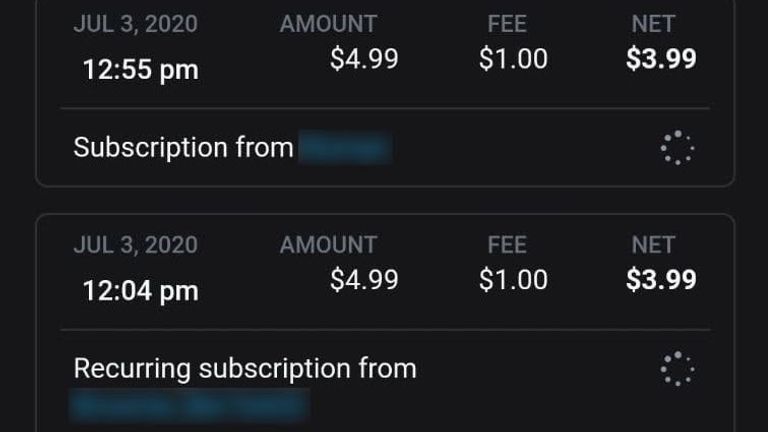

- Hi taita123, any income you receive via onlyfans would be considered business income.

- By: Spalla

- +454reps

- You will have to pay taxes as an onlyfans model.

- By: Graniah

- +64reps

- You can either file taxes by turbotax ,or freetaxusa.

- By: Allsopp

- +54reps

- Please remember this sub predominantly about advice.

- By: Pistol

pussy.pages.dev - 2022

DISCLAIMER: All models on pussy.pages.dev adult site are 18 years or older. pussy.pages.dev has a zero-tolerance policy against ILLEGAL pornography. All galleries and links are provided by 3rd parties. We have no control over the content of these pages. We take no responsibility for the content on any website which we link to, please use your own discretion while surfing the porn links.

Contact us | Privacy Policy | 18 USC 2257 | DMCA

DISCLAIMER: All models on pussy.pages.dev adult site are 18 years or older. pussy.pages.dev has a zero-tolerance policy against ILLEGAL pornography. All galleries and links are provided by 3rd parties. We have no control over the content of these pages. We take no responsibility for the content on any website which we link to, please use your own discretion while surfing the porn links.

Contact us | Privacy Policy | 18 USC 2257 | DMCA

(mh=mpGggujz63kbWa9N)12.jpg)